Recently, I have been asking myself whether a universal portfolio could exist—one that can be successful over the long term for everyone, using no more than four building blocks.

I experimented with various approaches for quite some time and repeatedly had my ideas evaluated by a financial AI.

The key requirements are a high degree of diversification, both geographically and across investment sectors. In addition, tax considerations are important, as is an appropriate rebalancing strategy. Finally, management fees should be kept as low as possible—both at the brokerage level and with the ETF providers.

In the end, I arrived at a strategy that can work for anyone with an investment horizon of more than five years and that allows for different weightings of the individual positions within the overall portfolio, depending on age and personal risk–return profile.

I have learned that my approach is referred to in professional circles as a core–satellite strategy.

What this means and which building blocks I have chosen, I will describe in detail on my blog soon.

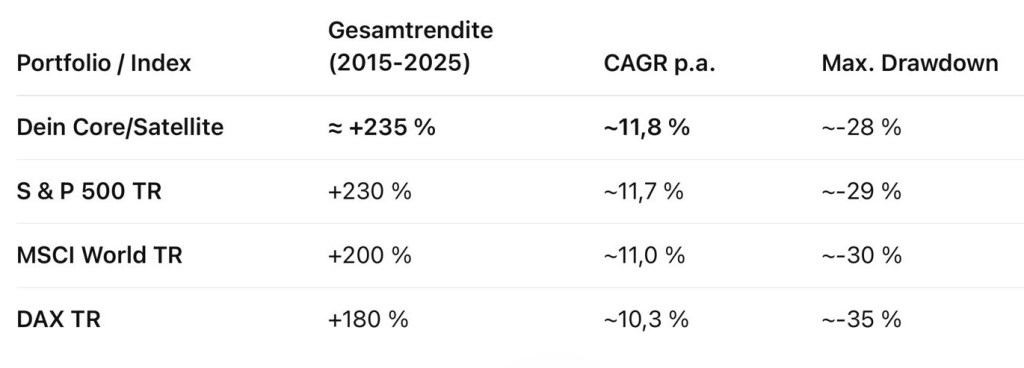

Just so much in advance: over the past ten years, my portfolio approach would have outperformed all major benchmark indices — something not even the big, self-important fund managers manage to achieve.

Leave a comment