A Summary for Investors

The financial landscape over 2025 and the outlook for 2026 can be described as a “tale of two speeds.” While the global economy remained surprisingly resilient, European investors faced a unique set of challenges that made even winning stocks feel like a stalemate.

The 2025 Review: The “Sideways” Trap

In 2025, U.S. markets (like the S&P 500) reached record highs, driven by the Artificial Intelligence (AI) boom and companies like Nvidia. However, if you were an investor sitting in Europe, your portfolio might have looked flat. Why?

The main culprit was the Currency Effect. In 2025, the Euro strengthened significantly against the US Dollar. When the Dollar loses value, your US stocks—which are priced in Dollars—become worth less when converted back to Euros. Essentially, the currency loss “ate” the stock market gains. Additionally, high trade tariffs and a sluggish industrial sector in Germany weighed down European indices, leading to high volatility.

The 2026 Outlook: Harvesting Growth

Looking ahead to 2026, the theme shifts from “surviving shocks” to “harvesting growth.”

USA:

Beyond the Hype. In 2026, AI is no longer just a buzzword. We expect to see real productivity gains as non-tech companies (in healthcare, finance, and logistics) fully integrate these tools. With the Federal Reserve having lowered interest rates in late 2025, US companies now have cheaper access to capital, which should fuel a projected market growth of 9–11%.

Europe:

The Steady Path. Europe remains slower but stable. While the US focuses on high-growth tech, Europe is the place for “Value” stocks—established companies that pay reliable dividends. The European Central Bank (ECB) is expected to keep interest rates higher for longer than the US, which may continue to support a strong Euro.

Currency Normalization.

The good news for 2026? The extreme currency swings of 2025 are expected to settle. This means if US stocks go up, European investors are more likely to see those profits reflected in their local accounts without them being wiped out by exchange rates.

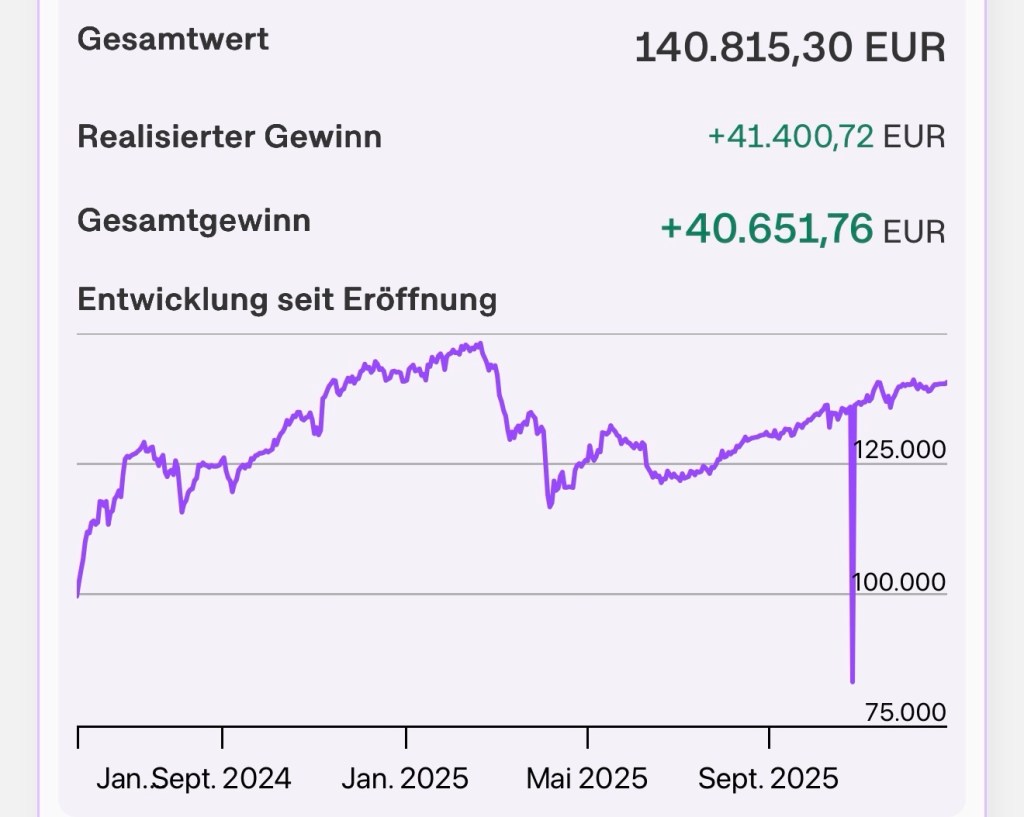

The Gondinero Index

In 2025 the index stepped sideways. The reasons are discussed above. Since the start in January 2024 it gained 40% and that proofs that the stock markets aren’t one-way streets.

Leave a comment