Good morning from Andalucía in Spain.

As I wrote recently I have the impression that market values are pretty high at the moment. Especially for the big tech stocks and thus for the S&P 500.

So in order to have a little buffer for major setbacks I, for the first time in my life, bought bonds in order to maintain the potential to react if the markets should really fall.

There is a nice letter in the financial times of today that tells me that I am not alone:

“Not all the growth in the economy comes from the AI building boom, as some contend, but a major slowdown would cause pain beyond just the tech industry. If there is one, diversification away from the cap-weighted S&P into equal- or fundamental-based indices, or into international stocks, will help, but probably only a little. Staples stocks, a much hated category recently, will probably outperform meaningfully. But what will really help is reasonable cash and bond allocations, and a cool head.”

But that doesn’t mean that I sold all the stocks.

I am still a long-term investor and will stay in my investments in stocks.

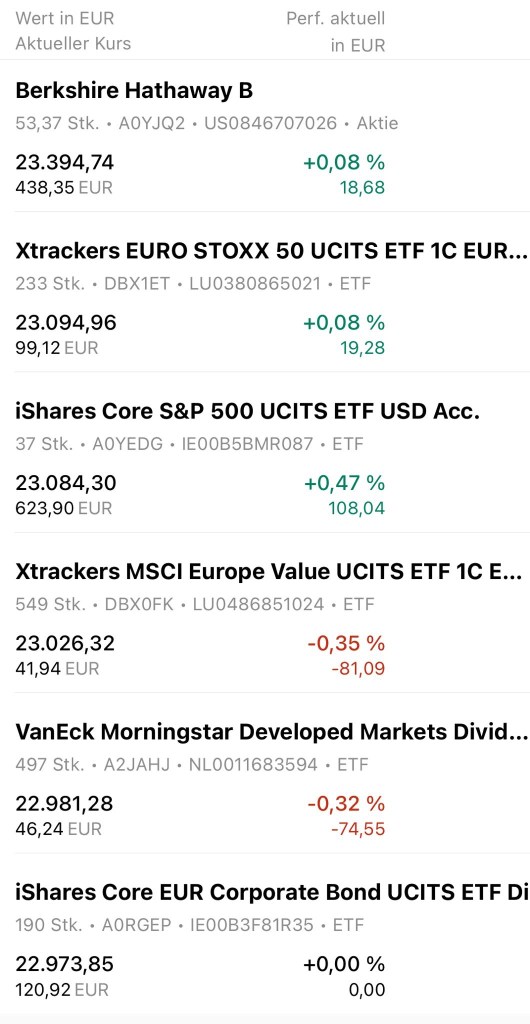

This is the new portfolio and you will see that I have six positions now that are equally weighted:

I chose this bond ETF for the following reasons:

No currency risk

It is fully EUR-denominated, which is ideal for our EUR-focused investment strategy.

High quality

Only investment-grade companies

→ more stable and crisis-resistant than equities

→ but offering higher yields than government bonds

Very broad diversification

- more than 3,000 bonds

- across many European sectors

- major issuers (insurers, telecoms, industry, banks)

Huge fund volume & extremely liquid

One of the largest bond ETFs in Europe → tight spreads, ideal for buying and selling.

THE TOTAL PORTFOLIO APPROACH

This is a really good article about long-term investment and it’s spiced with a lot of British humor. Really fun to read and thus relatively easy to understand 🤗

I must say that I like the FT 🥰

FT: The hot new investment trend is the ‘Total Portfolio Approach’. Does it work? (click)

RETURN FORECAST STOCKS VS. TREASURIES

RISK & REWARD

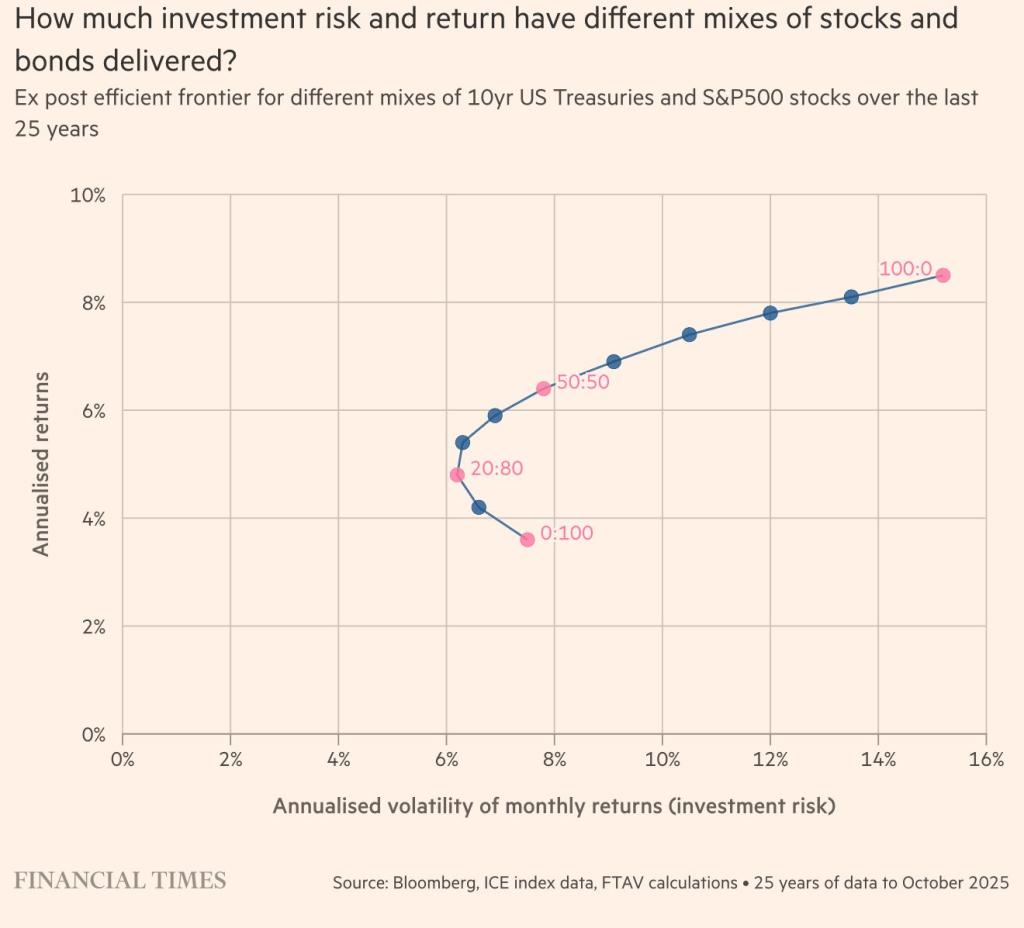

And this is a really good chart for explaining the correlation between risk and reward.

Being a mathematician I will calculate the best reward to risk ratio and get back to you later.

But you can see just in the optics that the lowest risk isn’t a 100% bond portfolio. That surprises me and I think the 50-50 allocation might be a really good one in this regard. But I’ll check.

I’m really excited, this is science what we do and we can earn from it 🤗

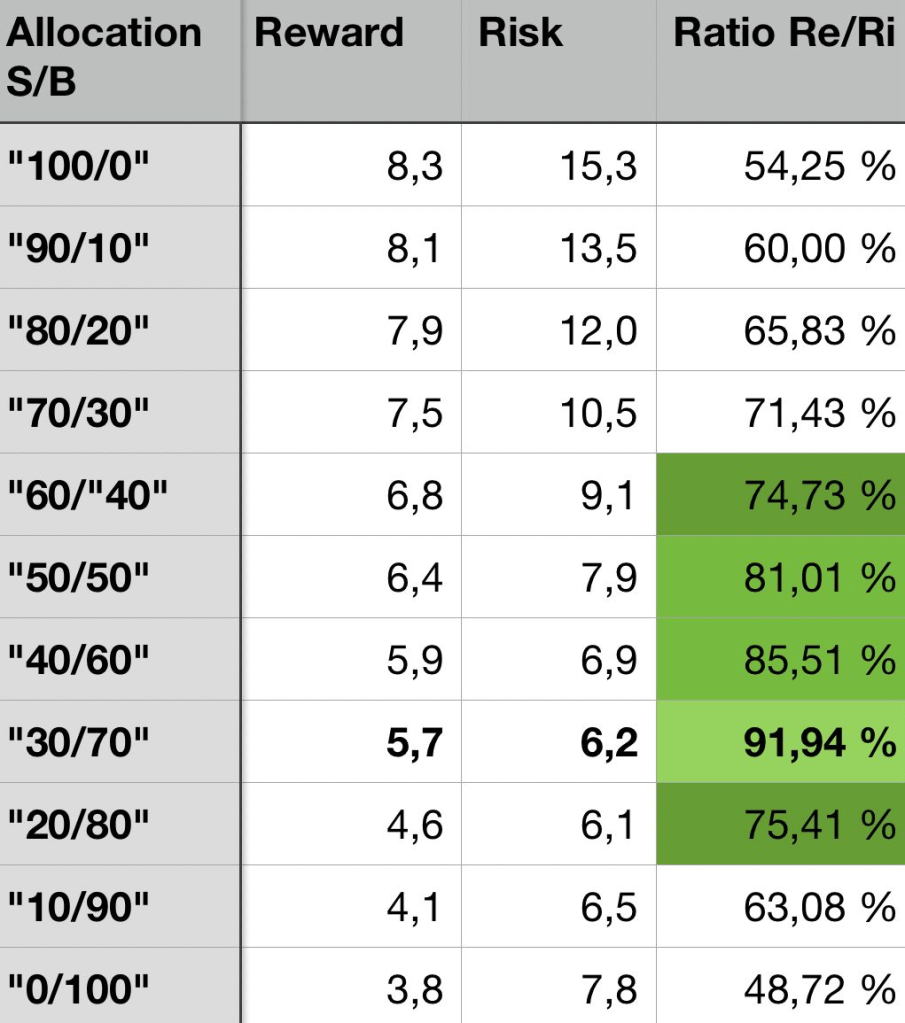

THE STOCK-BOND-OPTIMUM FOR THE NEXT 10 YEARS

Now I calculated the reward to risk ratio and surprisingly, based on the facts that I took from the financial times, this ratio is the highest, thus the best, when you have more bonds than stocks.

A 30/70 to 50/50 allocation stocks/bonds yield an optimum regarding reward/risk ratio.

Wow. I will check the facts in the next time and might adapt my strategy accordingly.

By the way: did you see the movie “The big short”? Exceptional good acting and entertaining and educating. With one of the most beautiful women in the world sitting in a bathtub explaining the world of financials to you.

And partaking Brad Pitt and Christian Bale, two handsome men as well.

Huge recommendation.

Leave a comment